The shift to permanent home working sparked by the coronavirus pandemic is expected to add a further £20bn to online retail sales by 2025.

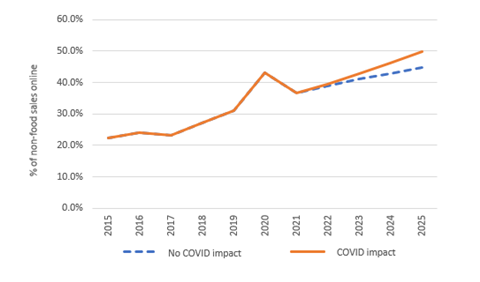

New data released today predicts that ecommerce will account for 49.7% of total non-food retail sales within the next three years, as the hybrid working measures many companies have adopted during the pandemic persist.

This new wave of “digital shifters” is expected to contribute an additional £22.4bn in online sales by 2025, compared to a scenario where the pandemic had no impact on shopper behaviour, according to Metapack and Retail Economics’ Ecommerce Delivery Benchmark report. Some £19.6bn of additional online sales will be fulfilled via home delivery.

Online expected to account for half of UK non-food sales by 2025

While the pandemic and working from home shifts have changed consumer behaviour across all retail categories, the research shows not all categories will be equally affected.

The survey shows that apparel, homewares and health and beauty retailers will have to learn to deal with a greater permanent shift online.

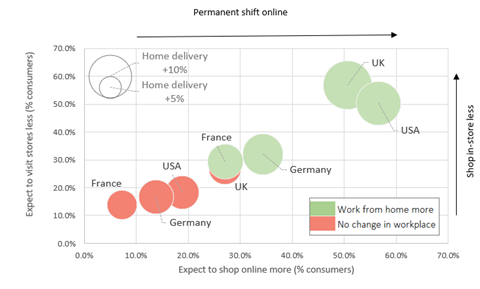

As a result, 38.5% of UK consumers expect to visit physical stores less in the future, ahead of those expecting to reduce visits in the US (28.7%), Germany (20.8%) and France (17.2%).

The great WFH disruption

More than a quarter of UK consumers now work from home more since the pandemic began and the data found more than half (50.6%) of those expect to shop more online going forward, compared to around a quarter (27.1%) whose place of work has not been impacted by coronavirus restrictions.

Shoppers working from home are accelerating structural shifts in retail

This increase in working from home has boosted the success rates of first-time deliveries and opened up a wider range of delivery slots. By 2025, UK home workers expect the proportion of online orders delivered to their home to rise 11.5%, compared to an average of 7.5% among those that have not faced changes in their workplace.

Retail Economics chief executive Richard Lim said: “A permanent shift in consumer behavior and vast investment across the ecommerce ecosystem has accelerated the shift to online. Structural changes in the labour market, with persistently higher levels of home working across households, has unlocked greater demand for home deliveries.

“Although the demand for speed will put pressure on supply chains, home workers have both a greater ability and greater willingness to pay for delivery and returns compared to average online shoppers, which is critical for profitability amid rising costs and elevated customer expectations.”

- Don’t miss the best of the week – sign up to receive the Editor’s Choice every Friday

No comments yet