PROMOTIONAL RESEARCH

With 2021 just around the corner, we get under the skin of the consumer and reveal what this means for retailers’ strategies in the year ahead.

In 2021 retailers and brands need to thrive, not just survive. To do so, understanding the consumer, how they’ve changed and what now drives them to buy will be critical.

Over the course of our Consumer 2021 week, RWRC is bringing you insights and opinions from the leaders of the biggest retailers in the UK and experts from outside the sector across a series of in-depth analysis articles and virtual events to help you navigate through the storm.

With two mornings of virtual events exclusive to retailers only, get under the skin of the new consumer and make sure your strategy is robust enough to withstand the turbulence, with insights from the likes of Lovehoney, Pour Moi, WARC and My Wardrobe HQ. You can watch Tuesday’s session on demand here and Thursday’s session here.

Portrait of the consumer

Make no mistake – the future shopper looks very different to the consumer of the early months of this year.

From the moment the UK went into lockdown on March 23, retail’s tectonic plates shifted.

Online sales soared while many stores were forced to close. Grocers struggled to keep up with demand while fashion retailers wondered where their next sale was coming from. City centres fell silent while local high streets saw a cautious increase in activity.

The question troubling retailers now is which of these behaviours will sustain into 2021 and beyond?

By piecing together shopper survey results, trading data and expert insight, a picture is beginning to emerge of next year’s shopper.

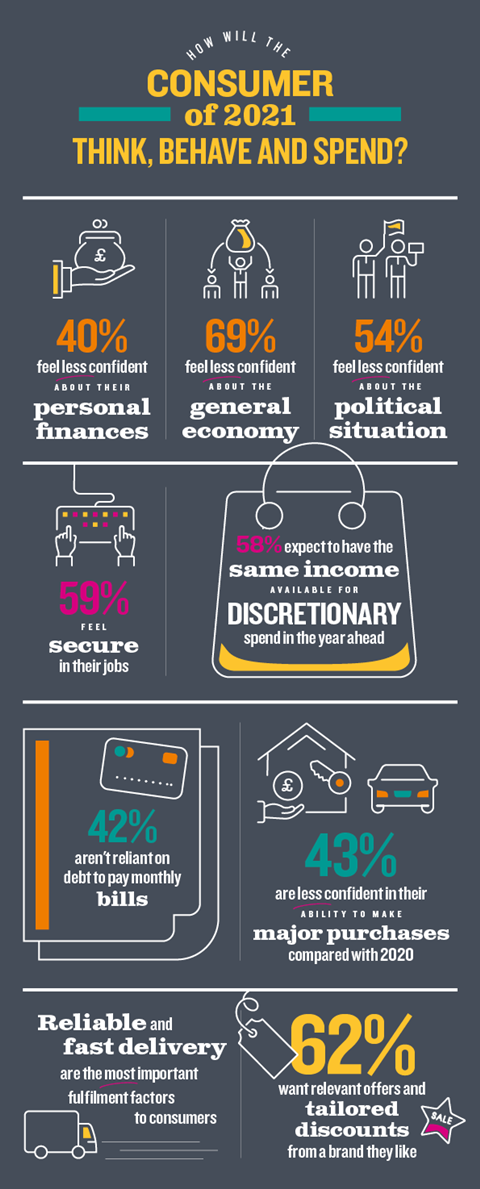

Exclusive Retail Week research, based on a nationally representative survey of 1,000 consumers in August, suggests people will feel less confident about their personal finances.

Purchasing decisions will be heavily influenced by price, and big-ticket or luxury items will suffer as a result. PwC research, however, shows promising signs for some big-ticket categories.

Shoppers will increasingly be looking for free, efficient delivery of products ordered online while remaining keen to support local businesses who serve their communities.

Not all doom and gloom

The good news is that, in spending terms at least, the coronavirus crisis of 2020 is not yet on a par with the financial crisis of 2008.

The latest Office for National Statistics (ONS) data for July shows that retail sales were the highest they have been since before the pandemic struck.

In fact, the ONS reported that, in terms of seasonally adjusted sales volumes, July 2020’s sales were higher than the previous year.

What has changed is where that money is being spent. Ecommerce sales in July were 50% higher than they were pre-Covid, while spending on non-essential categories such as fashion remained seriously challenged, with clothing sales running at 25.7% below pre-pandemic levels.

One of the biggest structural changes to the way people live their lives in 2021 will be spending more time at home

PwC has carried out research looking at the outlooks for different retail and consumer categories compared with the 2008 crisis. While categories such as homewares, furniture and DIY, which were hard-hit in the last recession, are expected to fare better, clothing and footwear are expected to do worse, reflecting the different social dynamics brought about by the response to Covid-19.

The PwC research demonstrates that one of the biggest structural changes to the way people live their lives in 2021 will be spending more time at home.

Retailers can expect to see a natural shift in spending to items that are home-oriented, such as grocery, home and garden, and a shift away from items that people in workplaces want and need, such as formal and occasion clothing and food to go.

Near-term prospects for embattled fashion retailers do not look like they will improve any time soon. In a survey by Retail Week, 45% of people said they would spend less on fashion this Christmas, versus 11% who plan to spend more.

By contrast, the majority of people say they will spend around the same on food, with 25% spending less and 22% more. Could this be a sign of things to come in 2021?

How well do you really know your shopper?

Delve deeper into this exclusive new research on the 2021 consumer in our panel discussion, sponsored by Epsilon-Conversant.

Speakers include:

- Jane Shepherdson, chair, MyWardrobeHQ

- Paul Kendrick, chief executive, Studio Retail Group

- Michael Thomson, chief executive, Pour Moi

There are, however, small signs of hope for fashion brands as we move into 2021, with respondents on average planning to spend 18% of their disposable income on non-grocery retail, compared with 16% now.

Moreover, there is a very real risk that disposable incomes will be considerably lower in 2021 than they are now. Incomes to date have largely been protected by government support schemes for those in employment and the self-employed.

ONS indicators for July 2020 suggest that the number of UK employees on payroll fell by around 730,000, compared with March 2020. But, as the furlough scheme is wound down, those figures are set to rise steeply.

Consumer confidence takes a tumble

Looking ahead to 2021, people are worried about their spending power. Of those surveyed, 40% feel less confident about their personal finances compared with how they feel right now, versus just 19% who feel more confident.

There is even weaker confidence in the general economy with 70% saying they are less confident against 12% who are more confident. Reassuringly, when it comes to job security, most people (59%) feel secure in their jobs.

![]()

The cost of living in 2021 is a worry to consumers, with 40% feeling less confident compared with 2020. Interestingly, women are less confident then men with 44% saying less, versus 35%.

Most people (42%) we surveyed are not reliant on debt, such as credit cards, store cards and personal loans, to pay monthly bills, with similar numbers for men and women. In general, the older consumers get, the less reliant they are on debt.

Meanwhile, 43% of people report that they are less confident in their ability to make major purchases in 2021, compared with just 13% who are more confident.

When broken down by age bracket, 18- to 24-year-olds are the most optimistic about making major purchases at 27%, but this dwindles by age until you get to 7.7% for those aged 65 and over.

A seam running through survey responses is that price will be a key determinant of how people intend to shop next year.

When comparing this Christmas with last, a low price (46%) or a discount (44%) will be more important to a greater proportion of people than, for instance, great customer service (29%).

Increasing price sensitivity is also reflected in the fact that 46% say free delivery will be more important this Christmas, versus just 14% who say less. This is a clear indication of how consumers intend to spend in 2021.

“If we are moving in and out of lockdown periods in future, retailers will adjust not only their stock assortments, but the functions of their stores”

Kathryn Bishop, The Future Laboratory

It is notable, however, that the shift to online, which has been such a central feature of the pandemic, may not sustain over the festive period.

Some 27% say they will spend more on a retailer’s website this Christmas than in 2019, versus 29% who will spend less. In addition, 19% plan to spend more on a retailer’s app, compared with 34% who will spend less.

Could this be a first indication that online fatigue is setting in and people are looking forward to getting back into shops in the run-up to Christmas and into 2021? Or is it simply a reflection that spending will be lower across all channels (with just 14% saying they intend to spend more in stores)?

Either way, experts don’t foresee the proportion of money spent online falling back to pre-pandemic levels.

The stores of 2021 and beyond are also likely to look very different to those in the past. Kathryn Bishop, foresight editor at consultancy The Future Laboratory, says: “If we are moving in and out of lockdown periods in future, brands and retailers will adjust not only their stock assortments, but the functions of their stores.”

Bishop believes stores will become either local fulfilment centres or ‘studio stores’ that double as a space from which brands deliver livestreams to boost sales or host personal virtual shopping.

“On the high street, pop-ups could find a new lease of life as a way to bring brands that are normally found in city centres, such as H&M, Uniqlo, Primark or M&S, to locals with seasonal boutiques that deliver curated edits in line with local customer needs – for example, back-to-school or last-minute Christmas gifts,” she adds.

Choosing where to shop

Local shopping, whether in high street chain stores or independents, is one pandemic trend that is set to sustain into Christmas and beyond.

Almost a third – 31% – of survey respondents say a desire to support local businesses will be a more important factor in their purchasing decisions this Christmas compared with last.

And while Mintel predicts that the peak in demand for convenience stores seen during lockdown is unlikely to sustain into 2021, particularly if social distancing measures continue to be relaxed, the market will still achieve consistent growth of 2% to 3% through to 2024, when it is forecast to reach £49bn.

“More than ever, the key success factor is to create hybrid digital and physical channels”

Thomas Husson, Forrester

While suburban and rural stores stand to benefit from more local shopping, the likelihood is that consumers will remain cautious of visiting crowded spaces such as city centres and shopping malls until a Covid-19 vaccine is developed.

In this context, retailers and landlords that have invested heavily in experiential retail over recent years will be forced to reimagine how they bring those experiences to customers.

Thomas Husson, vice-president and principal analyst at research agency Forrester, says it will be key for businesses to offer more options to consumers so they can have better “try before you buy” experiences, book appointments online and choose when and where to pick up products.

“More than ever, the key success factor is to [create] hybrid digital and physical channels,” he adds. “Nike recently opened a House of Innovation on the Champs-Élysées and their shop looks like an extension of their app.”

Husson says that, while it is critical for retailers to leverage technologies to design more virtual experiences, “flagship stores will not disappear”.

The challenge for retailers will be to reimagine those stores so they form a vital part of a future ecosystem where online shopping is ascendant.

The 2021 consumer is not yet fully formed. But there are enough clues for businesses to set about the task of building a customer proposition fit for a post-Covid world.

Join our virtual events

With leaders from the biggest retailers in the UK sharing insight from their organisations, as well as experts from outside the sector giving their expertise, this is a must-attend for any retailer who wants to succeed in 2021.

Sessions include:

- Retail in 2020: who got it right?

- The great customer experience redesign

- What you need to thrive during tough economic times

- The 2020 consumer trends that are here to stay

You can view the full schedule here. To watch Tuesday’s session on demand click here and to watch Thursday’s session on demand click here.

No comments yet