PROMOTIONAL RESEARCH

Updated quarterly, our online search rankings – in association with Pi Datametrics – chart the top 20 websites by product search terms.

Our online search ranking allows retailers to understand the true value of their online visibility and focus their ecommerce efforts on content that will deliver the best results.

Covering 27 million Google UK searches monthly, each search term is assigned a value based on its frequency, popularity and ability to convert into a sale (full methodology below).

Click here to learn more about the value of SEO.

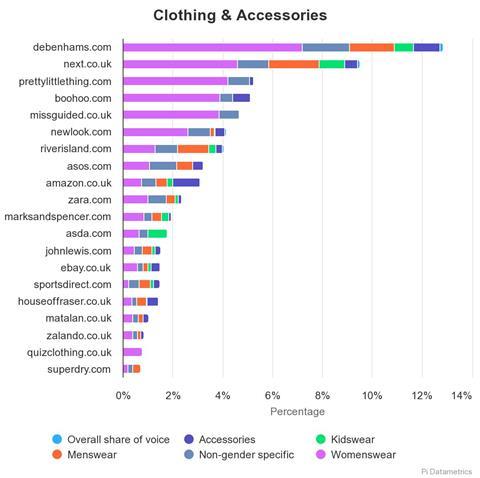

Top 20 clothing and accessories websites by online share of voice

Top performers

It’s no surprise that an increasing amount of consumer spend is online.

For this reason, major bricks-and-mortar brands have been investing in digital for some time – and the ones that haven’t have probably left the high street already.

It may recently have had issues in other areas of the business, but Debenhams’ online presence is of a high standard, with complete domination of the clothing and accessories SEO landscape at 12.7%, with strong performance across all categories.

Recognising search as a major source for its business growth and online brand presence, within the SEO industry Debenhams is renowned for hiring talented personnel to help drive its online success, even receiving national awards for its efforts.

While Debenhams has the highest online share of voice in womenswear, Next, another major high street brand, has the highest share in menswear, showing there’s still room for Debenhams’ dominant position to grow.

Fast-fashion brands

Positions three, four and five in the ranking are ecommerce-first fashion brands – Pretty Little Thing, Boohoo and Missguided – showing the strong digital capabilities of online start-ups.

All three retailers perform well in womenswear and non-gender-specific categories, but have a very small percentage of the menswear category – something Boohoo specifically will no doubt be focused on, due to its Boohoo Man collection.

Whilst fast-fashion etail giant Boohoo owns Pretty Little Thing, after buying the controlling stake in the company in 2016, the combined online share of voice of 10.33% still isn’t enough to overtake Debenhams. However, it puts the joint businesses in a strong position in comparison to their immediate competitors.

Improving its online reach in menswear will put Boohoo in an even stronger position while competing with other Gen-Z-focused fashion brands, such as Quiz, which is also currently aiming to satisfy the increasing demand for young men’s fast fashion.

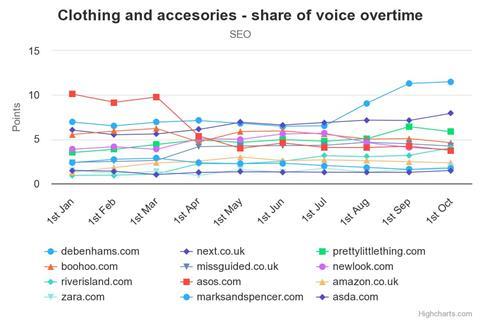

Share of voice over time

Debenhams has risen to dizzying heights since last quarter, increasing its share of voice online by an impressive six percentage points (nearly double that of July), with Next not only retaining its second-place spot but making some healthy gains.

Uplift across both Debenhams and Next may potentially be a result of House of Fraser’s website going offline for a month, leaving opportunity for others in the market to take their share.

Asos had a rather dramatic fall from grace at the start of Q2, dropping from a dominant leading position to middle of the pack.

In early 2018, Asos updated its site to showcase a more minimalistic style, which included reducing or entirely removing some of its key category and product page content.

This website change may have contributed to its decline in online share of voice – could it have also contributed to its recent business performance warnings?

How does the weather influence SEO?

As the seasons change, so do the volume of searches and the categories focused on by customers, with some brands performing stronger for spring/summer and weaker for autumn/winter.

New Look, Debenhams and Pretty Little Thing all performed highly earlier in the year during the warmer weather.

However, while Debenhams continues to excel, New Look seem to be declining based on its autumn/winter performance – for long-term stable growth, a selection of high-quality content across all product areas is essential to anticipate demand.

Want to see a bespoke report?

Get personalised insight on your performance – contact uk@pi-datametrics.com or visit pi-datametrics.com.

Methodology

Using Pi Market Intelligence, more than 35,000 of the most commercially valuable online search terms within the retail sector have been analysed.

Each individual search term is given an Organic Value Score (OVS) to determine its commercial value and potential to convert. This is achieved by assessing key conversion metrics for each search term, including search volume, cost-per-click and competition in the market.

Click here to read the full breakdown of Pi Datametrics’ SEO ranking methodology.

No comments yet