PROMOTIONAL RESEARCH

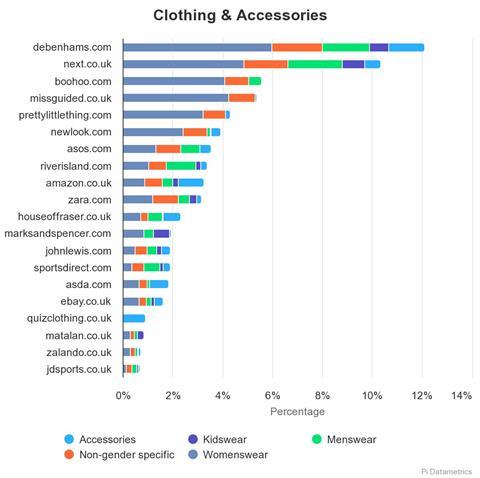

Updated quarterly, our online search ranking – in association with Pi Datametrics – charts the top 20 clothing and accessory websites by product search terms.

Our online search ranking allows retailers to understand the true value of their online visibility and focus their ecommerce efforts on content that will deliver the best results.

Covering 27 million Google UK searches monthly, each search term is assigned a value based on its frequency, popularity and ability to convert into a sale (full methodology below).

Click here to learn more about the value of SEO.

Q4 online search ranking - Top 20 clothing and accessories websites

Top performers

Debenhams continues to take the lead in UK online fashion retail, retaining the number one ranking it achieved at the start of Q3.

The department store business grew its online share of voice drastically throughout 2018, almost doubling its 6.96% stake in January to 12% in December.

Debenhams’ Q4 digital sales rose in line with this visibility, growing 6% over the Christmas period, which went some way to offsetting weak store footfall.

Hot on its heels, Next also grew its online share of voice dramatically in 2018, from 5.93% in January to 9.52% by December.

Next’s 2018 Christmas trading update recorded a 1.5% rise in fourth-quarter sales, driven by a late sales surge online. Ecommerce sales rose 15.2% to £17m, with physical sales declining 9.2% during the same period to £16m.

The fashion and homewares retailer said its December performance had “made up for disappointing sales in November”, and will no doubt have benefited from its strong standing in online search.

Also experiencing growth over the Black Friday and Christmas season were fast-fashion favourites Boohoo (up one place, to third), Missguided (up one, to fourth), Asos (up one, to seventh) and Quiz (up two places, to 17th).

Back from the brink

The real success story of 2018’s final quarter was the resurrection of House of Fraser. The retailer’s online share of voice has increased significantly since Q3, and its ranking on the leaderboard has climbed five places.

This can likely be attributed to new owner Mike Ashley bringing the luxury department store back online, after initially shutting down the HoF website in Q2 following its acquisition.

What’s important to note is how HoF’s assets managed to regain their visibility so instantaneously, which speaks volumes about the online authority and digital equity of the brand.

Although seen as slightly less relevant players in the fashion sector, Marks & Spencer (down one), Asda (down three) and Ebay (down four) are potentially paying the price as a result of HoF’s recent comeback.

Not all marketplaces are losing out, however. Amazon has maintained its top 10 position, while a new entry arrives this quarter in the form of Zalando, in position 20 out of more than 40,000 possible websites.

Want to see a bespoke report?

Get personalised insight on your performance – contact uk@pi-datametrics.com or visit pi-datametrics.com.

Methodology

Using Pi Market Intelligence, more than 35,000 of the most commercially valuable online search terms within the retail sector have been analysed.

Each individual search term is given an Organic Value Score (OVS) to determine its commercial value and potential to convert. This is achieved by assessing key conversion metrics for each search term, including search volume, cost-per-click and competition in the market.

Click here to read the full breakdown of Pi Datametrics’ SEO ranking methodology.

2 Readers' comments