PROMOTIONAL RESEARCH

This article was published before the onset of the coronavirus pandemic

2019 was described as the worst year for retail in history, but the signs are more positive for 2020.

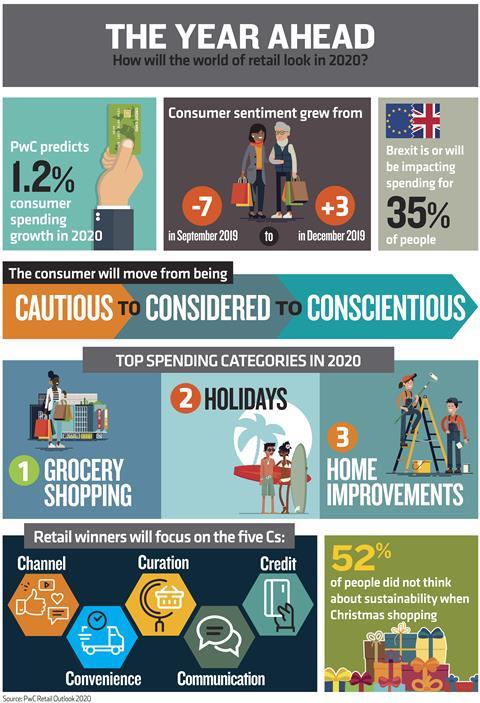

Consumer confidence rose from -7 in September 2019 to +3 in December, according to PwC’s Consumer Sentiment Survey, and the UK’s official withdrawal from Europe has brought an air of political certainty.

According to Retail Week and PwC’s Retail Briefing 2020 there is growth potential for retailers this year. PwC’s main forecast scenario this year is for 1% real growth in both UK GDP and consumer spending.

However, shoppers being more considered in their purchases is a trend that’s here to stay and retailers must adapt. Be it because of environmental concerns, ongoing Brexit fears or a desire to become less frivolous, there is a growing number of people determined to buy less.

How will they spend it?

Consumers’ spending priorities are forecast to shift in 2020. Notably, shoppers are prepared to resume spending on major purchases in the year ahead. The biggest recovery in spending sentiment was in the home improvement category, according to PwC research.

The housing market is improving with prices rising at their fastest annual rate for nearly two years last month, according to Halifax, and estate agent Savills reported an increase in house sales following the general election. This could persuade people to invest in their homes to prepare them for sale.

To find out shoppers’ spending priorities across categories in 2020, download Retail Briefing 2020 for free today

However, for food retailers, 2020 is unlikely to bring any respite. When asked about spending intentions for the year ahead, shoppers usually factor in food inflation so prepare to spend more. However, this year, only a net 3% of those surveyed by PwC expect to spend more on their groceries, compared with 11% last year.

There are many factors that are impacting shoppers’ food shopping habits. Almost a third of those surveyed said they were committed to wasting less, while 22% said they simply intended to buy fewer groceries.

To win in this crowded market, grocers need to give people a reason to shop, which means investing in four main areas: price, product innovation, stores and staff.

To find out more on how and where the 2020 consumer will shop, download Retail Week and PwC’s Retail Briefing 2020 to discover:

- The economic forecast for the year ahead

- Consumer spending intentions across all categories

- The big trends in grocery and clothing in 2020

- How retailers can persuade consumers to shop with them