PROMOTIONAL RESEARCH

Updated quarterly, our online search rankings – in association with Pi Datametrics – chart the top 20 websites by product search terms.

Our online search ranking allows retailers to understand the true value of their online visibility and focus their ecommerce efforts on content that will deliver the best results.

Covering 27 million Google UK searches monthly, each search term is assigned a value based on its frequency, popularity and ability to convert into a sale (full methodology below).

Click here to learn more about the value of SEO.

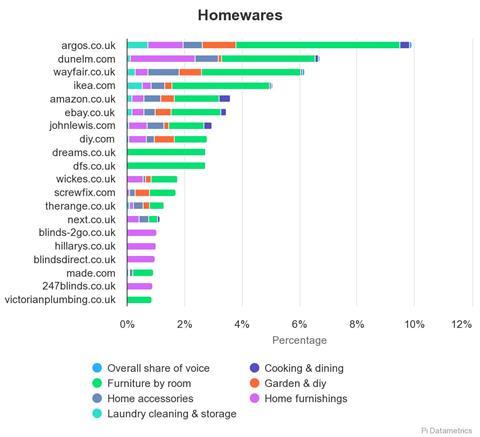

Top 20 homewares websites by online share of voice

Top performers

At the end of Q2 Argos had the highest share of voice online by a fair margin, performing best in the ‘Furniture by room’ category.

The multichannel retailer’s clear site structure and vast amount of products puts them at a strong advantage when optimising for Google.

The first non-grocery retailer to launch voice shopping capabilities in the UK, Argos will need to expand its SEO capabilities to incorporate voice search, to ensure its online share of voice remains loudest across all platforms.

John Lewis and Partners, which has historically prided itself on its homeware product range, is significantly behind its discounted competitors Dunelm and Wayfair.

As a department store, JLP is not focused on one specific category, which may put it at a disadvantage when looking at performance at a category level – its SEO focus will be much broader compared to a homewares-only brand.

Global retail giant Amazon ranks fifth this quarter, indicating a rising interest in its two recently launched private-label furniture brands, Rivet and Stone & Beam.

The emergence of these two new brands, alongside its already burgeoning homeware offering, shows Amazon is set to continue to be a major player in this sector (as well as many others).

Why do marketplaces do well?

Google loves content, and the very best marketplaces have vast amounts of content uploaded by both vendors and users alike.

A quick site search for Amazon UK shows that it has 92,400 pages indexed in Google UK that have the word ‘sofa’ in its page title – doing the same search for DFS (a sofa specialist) produces only 3,190 pages in comparison.

The sheer weight of this content alone propels Amazon and Ebay to become top performers in many different and disparate categories, without adding in the huge amount of links the sites receive from mainstream PR and social media, making it no surprise that Google really rates these marketplace behemoths.

The rise of the online specialists

With specialists and generalists in every sector, online retail is a complex competitor landscape.

Interestingly, 20% of the sites performing well in the homewares category are specialist blind suppliers.

As explained in the full methodology, Pi Datametric’s online share of voice ranking includes a ‘value’ overlay, allowing niche retailers to make it into the top 20 performers from a ‘commercial visibility’ stance.

Blinds are one of the highest priced products within the furniture category, which is reflected in online competition and cost-per-click (CPC) for ‘blinds’ terms.

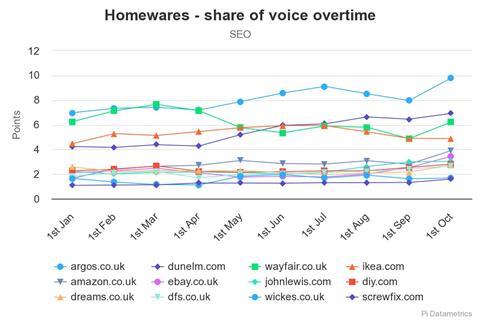

Share of voice over time

Ebay may have seen a significant uplift over the quarter, with a 1.68% increase – three positions higher than at the beginning of Q3 – but Argos has been the unchallenged leader in homewares online all quarter, after fighting off competition from Wayfair in the first half of the year.

Wayfair and Ikea have been competing closely throughout Q3 for third and fourth place, with Wayfair’s position fluctuating significantly.

Wayfair seems to have both a US and a UK site competing in Google UK – this is known as ‘international cannibalisation’, one of the most common problems for international brands.

Google sees that the sites are ostensibly duplicates of one another, and so the search engine regularly fluctuates between giving credit to one or the other site.

Websites can resolve this issue with site-wide tagging, consolidating performance for the UK site and therefore theoretically beating Ikea in this extremely lucrative online sector.

Want to see a bespoke report?

Get personalised insight on your performance – contact uk@pi-datametrics.com or visit pi-datametrics.com.

Methodology

Using Pi Market Intelligence, more than 35,000 of the most commercially valuable online search terms within the retail sector have been analysed.

Each individual search term is given an Organic Value Score (OVS) to determine its commercial value and potential to convert. This is achieved by assessing key conversion metrics for each search term, including search volume, cost-per-click and competition in the market.

Click here to read the full breakdown of Pi Datametrics’ SEO ranking methodology.

No comments yet