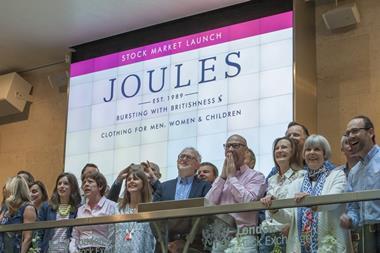

Fashion retailer Joules is set to float on London’s Aim market this week with each share priced at 160p, which values the firm at £140m.

The retailer is due to float on AIM on Thursday and hopes to raise proceeds of about £77.5m from the listing.

Of this capital, Joules plans to use £11.5m to repay an outstanding shareholder loan and will invest the remaining cash injection into accelerating its UK and international expansion.

Joules has 98 stores in the UK and Ireland and reported a 198% increase in sales in its international market, which comprise stores in the US and Germany, between 2013 and 2015.

The retailer, whose flotation has been rumoured for some months, was revealed by Retail Week to be interested in acquiring a handful of Austin Reed’s stores after it collapsed into administration last month.

Chief executive Tom Joule, who holds 32.2% of the issued share capital of the business after reducing his stake from 80% earlier this month, stands to make about £60m from the listing.

“Today’s announcement marks an exciting new phase in Joules’ development as a premium lifestyle brand,” said Joule.

“Joules is a much loved brand with a rare heritage and we are delighted with the strong response to the placing, reflecting investors’ recognition of the significant further opportunities for the group both in the UK and internationally.”

Joules has appointed brokers Peel Hunt and Liberum to run the flotation and has conditionally allocated the entirety of its available shares ahead of its listing to interested investors.

No comments yet