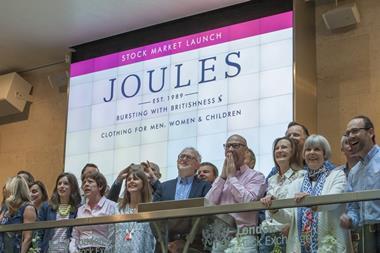

Joules, the fashion retailer famous for its colourful clothes, is eyeing an IPO that could value the business at about £150m.

Joules has appointed brokers Liberum and Peel Hunt to run the flotation, according to the Sunday Telegraph.

The retailer is thought likely to come to market in April or May and a successful IPO would allow Tom Joule, who built the business up from its origins selling clothes at equestrian shows, to realise some of his investment.

He owns 80% of Joules. The rest is owned by private equity house LDC, which put £22m into the retailer three years ago.

Tom Joule bought out the business from his father 17 years ago.

The retailer now has approximately 100 stores and its lines are sold in department stores including Debenhams and John Lewis.

Joules’ sales rose 21.6% to £117.1m in the most recent year for which accounts have been filed at Companies House. Pre-tax profits climbed 35.5% to £5m.

A flotation would be an impressive achievement amid turbulent market conditions because of concerns about the global economy and the health of the banking sector.

A spokesman for Joules declined to comment.

No comments yet