Waterstones has secured £125m in new funding facilities, which it said is designed to support the company’s ongoing financing needs and future growth.

The new facilities were jointly arranged by Barclays UK Corporate Bank and HSBC UK Bank and includes a £75m loan and a £50m revolving credit facility.

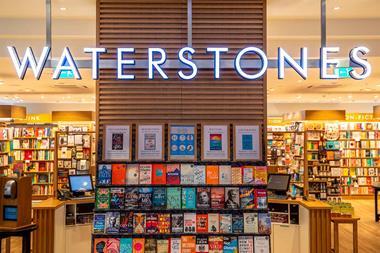

The retailer operates nearly 320 bookshops across the UK, Ireland and Europe, as well as trading online.

Waterstones chief financial officer Karen Ashworth said: “Waterstones would like to thank Barclays and HSBC for their continued partnership in increasing the syndicated facility that supports the financing needs of the business.”

It comes after the retailer announced in April that it would be halting US trading following the implementation of US president Donald Trump’s first wave of tariffs announced that month.

The book seller’s chief executive James Daunt also teased the idea of a float on the London Stock Exchange, saying the City was an attractive market for retail businesses and highlighting the revival of Marks & Spencer and Next’s consistently great performance since going public on the stock market.

He said: “Waterstones is a solid, predictable retailer with steady growth and dividend payouts. Our business is like Next. We are moderate and predictable.”

Daunt owns Barnes and Nobles in the US and has headed up Waterstones since 2011.

The chain has been owned by private equity firm Elliott Advisors since 2018, but Daunt added: “At some point in the near future it will look to cash in its chips.”

Waterstones reported pre-tax profits of £42.9m in the 12 months to April 27, 2024, up £11.2m from the previous year.

Its revenues also jumped from £452.4m to £528.3m in the same period. Daunt recently said Waterstones is planning to open dozens of new stores across the UK in 2025.

No comments yet