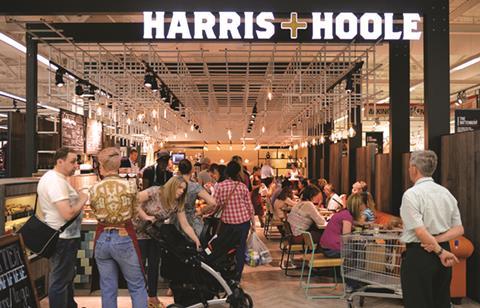

Three years after buying into Harris + Hoole alongside venture partners the Tolley family, Tesco has acquired the remainder of the business.

The coffee shop chain has failed to live up to the Tesco board’s lofty expectations so far, posting a pre-tax loss of £25.6m in the year ending March 1, 2015.

That performance has split opinions among onlookers about whether Tesco had made the right decision by opting to take full control of the artisan-style shops.

Retail Week spoke to two analysts to get their contrasting answers to the question, was Tesco right to take full ownership of Harris + Hoole?

‘YES’ says David Gray, senior retail analyst at Planet Retail

“On the face of it, the move to acquire the remainder of the Harris + Hoole coffee shop business is not entirely unexpected considering Tesco always had an option to buy its joint venture partners out after three years.

“Although the Harris + Hoole business hasn’t performed to management’s expectations, there are several reasons to suggest that there is still a place for it in the Tesco fold as a fully-owned entity.

Profit potential

“First, by introducing a foodservice proposition into stores, Tesco can increase dwell time, which can lead to higher sales. This is not something to be dismissed lightly, especially at a time when out-of-town shops are suffering at the hands of shifting shopping habits towards discounters and smaller c-stores.

“If Tesco can get it right, there is the opportunity to generate a profit from this business”

David Gray, Planet Retail

“Secondly, selling coffee is generally a high-margin business. If Tesco can get it right, there is the opportunity to generate a profit, especially considering that most Harris + Hoole branches sit inside Tesco hypermarkets. With that in mind, there can’t be much in the way of a rental bill for the fledgling coffee shop arm.

Productivity push

“Thirdly, there is the opportunity to increase floorspace productivity, and by this I mean sales densities. In effect the average coffee shop takes up a fraction of a Tesco store, but can generate decent revenues.

“Fourth, and the most widely known reason, is using foodservice to create destination appeal. By this I mean the store’s ability to pull in footfall – something that is crucial to a successful retail proposition.

“All of the above can only be achieved if the proposition is right and work is definitely needed here. Full ownership may give Tesco the ability to better tailor the concept to the needs of its larger store customers.

“I don’t see the acquisition of the remainder of Harris + Hoole as the answer to Tesco’s big-box problems, but as part of a wider package of measures it may have a part to play.”

‘NO’ says Mike Dennis, managing director at broker Cantor Fitzgerald

“Tesco has shown an ability to lose money in a market that has been one of the fastest expanding in the high street.

“There have been various jokes and cartoons in national papers showing people walking down the high street and asking ‘where can I get a coffee?’ Every single shop behind them is a coffee shop.

“There is no doubt that the coffee market is exceptionally profitable, but Tesco last year managed to make it exceptionally loss-making. It lost £25m last year on close to £13m of turnover, which is pretty special.

“Most coffee shops work on the basis of making 80% gross margins and 20% EBITDA margins so, arguably, it’s a good idea for Tesco. Milk prices have fallen dramatically, coffee prices will be minimal for a company the size of Tesco and you are providing a premium service that serves a volume market.

Wide portfolio

“Is there an opportunity to make a good return on it? Absolutely. So it’s got all the ingredients, but are supermarkets particularly entrepreneurial? No.

“I think it’s an unnecessary distraction and it’s too small a business. Tesco has got bigger businesses in its portfolio that are more profitable and it hasn’t invested in them”

Mike Dennis, Cantor Fitzgerald

“I think it’s an unnecessary distraction and it’s too small a business. Tesco has got bigger businesses in its portfolio, such as Dobbies garden centres, that are more profitable and it hasn’t invested in them.

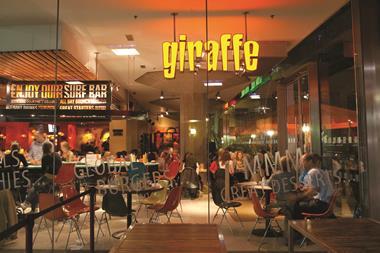

“When you add Giraffe into the mix as well, Tesco hasn’t been particularly successful when it comes to ownership of these service businesses.

“And, quite honestly, that’s part of the problem. These businesses would be better off as standalone operations than they are being owned by a corporate.

“It will be interesting to see what happens in the next three years now to Harris + Hoole, but I’m not projecting an instant recovery into industry-level margins.”

No comments yet