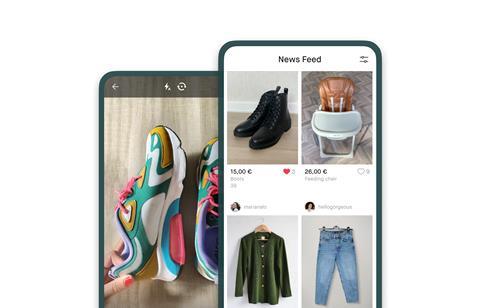

Lithuanian online marketplace Vinted is reportedly in talks about a sale of shares that could be worth more than €200m (£174m) in its bid to lead the sustainable fashion boom.

Vinted is working with Morgan Stanley to “consider options for its capital structure ahead of a potential initial public offering”, as reported by the Financial Times.

Sources familiar with the matter said that the marketplace is “debating all options”, including the option to sell new shares as well as existing ones, according to the newspaper.

Vinted could also reportedly stick with its current capital structure “given the recent economic turmoil”.

If a secondary share sale goes ahead, it could see Vinted valued at a premium, compared with its prior valuation of £3bn (€3.44bn), as well as helping to generate cash for early investors.

Discussions are said to be at an “early stage” and sources said that Vinted’s plans are still open to change.

Both Vinted and Morgan Stanley declined to comment.

Vinted posted group revenue of €245m (£213m) for 2021, while also recording a loss of €118m (£103m). lt also cited 80 million registered users across 19 markets globally, according to the most recent figures.

Vinted Marketplace chief executive Adam Jay told Retail Week earlier this year that Vinted is only at the beginning of its journey.

He said: “We truly do want secondhand to be the first choice and we think that is an achievable ambition in the long term but it will take time. It takes time to educate both buyers and sellers on the benefits of secondhand and that it can actually be quite an enjoyable experience.”

No comments yet