Retail footfall plunged at the sharpest rate in almost five years during December as consumers flocked online to make Christmas purchases.

Shopper numbers fell 3.5% in the five weeks to December 30 compared to the same period a year ago.

According to the BRC-Springboard Footfall and Vacancies Monitor, the slump marked the steepest decline since March 2013, when footfall tumbled 5.2%.

It was also “significantly below” the average footfall over three-month and 12-month periods, which suffered 1.9% and 0.7% declines respectively.

The monthly barometer suggested that all types of location suffered sharp declines in consumer traffic during December.

Footfall dropped 3.2% in shopping centres, while high streets and retail parks both suffered 3.1% declines.

All parts of the UK were hit by falling shopper numbers, with the steepest declines recorded in the Southwest, Scotland and Greater London with 5.2%, 4.7% and 3.7% downturns respectively.

Retail parks were the only shopping destinations to register any kind of growth on a regional basis, as footfall to out-of-town schemes inched up 0.9% in the Southeast and 0.1% in the West Midlands.

BRC chief executive Helen Dickinson said the figures highlighted that shopping “is being transformed by the shift to online”.

Mixed results

Retailers including Debenhams, House of Fraser and Mothercare have all reported disappointing Christmas trading figures, whereas fashion etailer Boohoo doubled its revenues during the crucial four months to December 31.

Dickinson said: “In the past, shoppers would have exclusively visited physical stores to ensure stockings were filled for Christmas.

“Improved delivery options by both purely digital retailers and those with stores and an online offer mean many purchases of last-minute gifts are moving online.”

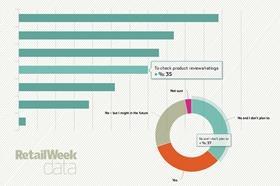

She added that squeezed consumer spending also contributed to the decline in footfall as shoppers researched products online “rather than heading out to stores to browse”.

Springboard marketing and insights director Diane Wehrle added that the slump in footfall was “of little surprise” given modern shopping habits.

Wehrle added: “It is apparent that retailers need to focus on maximising conversion via the core deliverable of best product and customer service with an improved in-store experience, while holding their nerve and resisting discounting too early and so protecting margin.”

No comments yet