Retail spending is expected to take a £2.4bn hit this year as consumers are impacted by “lower levels of affluence” amid the cost-of-living crisis, according to the latest research by Retail Economics and beBettor.

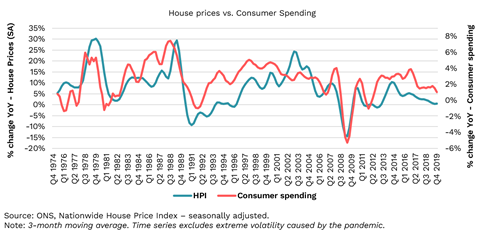

The research found the hit on spending is a result of consumers holding back and saving more due to feeling “lower levels of affluence” and a need to compensate for lost wealth, which is known as the “negative wealth effect”.

The impact is taking the biggest toll on “aspirational millennial” shoppers, rather than less affluent shoppers, marking a second wave of the cost-of-living crisis.

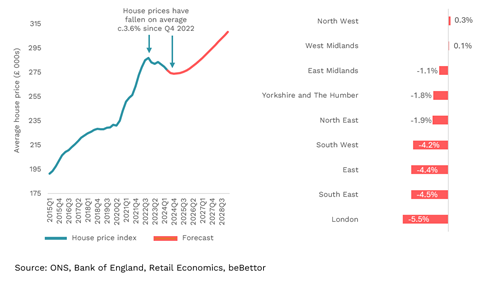

The research shows this comes as a direct consequence of previous declines in house prices, which have seen a drop of 3.6% from the fourth quarter of 2022 to the second quarter of 2024, alongside other declining assets.

Retail Economics emphasised that rising mortgage rates “profoundly influence” consumer sentiment, taking their toll on consumer confidence and discretionary spending.

One in five consumers have increased their level of savings in the three months to January 2024, marking a record high since the pandemic.

As millennials are “crucial” customers for the luxury sector, the decline in spending from this demographic coincides with the struggles facing the luxury market.

Luxury retailers including LVMH, Gucci and Versace owner Capri Holdings all posted declines in sales year on year, while Burberry recently issued a profit warning and blamed the slowdown in luxury spend on the cost-of-living crisis.

Retail Economics said the anticipated £2.4bn reduction in spend reflects an “urgent need” for retailers to adapt to the evolving economic landscape.

It added that the retailers that can adapt and understand customer affluence are the ones who will “ride out the storm better than most”.

Retail Economics chief executive Richard Lim said: “Rising mortgage rates have expanded the scope of the cost-of-living crisis to include more middle- and higher-income households. This effect has particularly impacted aspirational millennials, a demographic that has been pivotal in driving the luxury market over the past decade, which is now facing the brunt of these economic shifts.

“Softer levels of financial confidence not only underscore the broader implications of the negative wealth effect but also signal a critical moment for luxury retailers.

“Understanding the financial landscape of this key consumer base is more vital than ever. As they reassess their spending in light of diminished asset values, the luxury sector must adapt and seek to embrace the latest tools available to maintain its relevance and appeal to this influential group.”

beBettor chief executive Harry Cott said: “Amid the prevailing economic headwinds, softer levels of spending across the luxury market appears to be underpinned by the tangible impact of declining consumer wealth.

“This situation underscores a critical juncture for retailers, emphasising the need to better understand customer affluence. Now, more than ever, adopting a differentiated approach to consumer engagement informed by customer affluence is a cornerstone of resilience.

“By leveraging detailed insights into customer wealth, retailers can identify low spending cohorts with additional headroom to spend, improve personalisation and better predict LTV to navigate through these turbulent times with precision.”

No comments yet