THG (formerly the Hut Group) has signed a deal with Japanese conglomerate SoftBank to receive $2.3bn (£1.6bn) in investment.

As part of the deal SoftBank, a tech firm owned by the richest man in Japan Masayoshi Son, will purchase $730m (£517m) in new shares in THG as part of a $1bn (£708m) cash call.

SoftBank’s investment will give the company around a 9% share in THG, while the tech mogul is also taking a 19.9% stake in THG’s Ingenuity platform valued at $6.3bn (£4.5bn).

THG Ingenuity is the health and beauty retailer’s technology arm that helps other brands and retailers improve their ecommerce capabilities.

To receive the extra investment from SoftBank, THG Ingenuity will become a separate legal entity from THG itself by the end of next summer.

THG has at the same time announced the acquisition of prestige beauty development and manufacturing firm Bentley Laboratories, as it seeks to grow its expertise in health and beauty through targeted M&A activity.

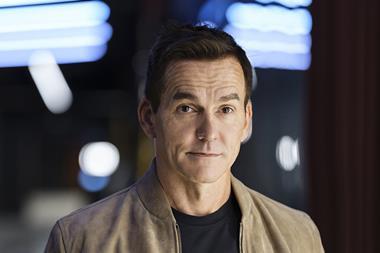

Founder and chief executive Matt Moulding said: “We are delighted to announce this financial and trading partnership opportunity with SoftBank, one of the world’s leading technology investors, recognising both the capability and inherent value of our proprietary technology platform, Ingenuity.

“The trading partnership opportunity is particularly exciting, providing Ingenuity with an unparalleled global growth opportunity.

“Furthermore, the combination of the acceleration of growth within Ingenuity and its separation into a distinct entity will enable THG to unlock significant incremental shareholder value over time.

“The capital raise will provide meaningful capital to accelerate our strategic growth ambitions across our whole business.

“The acquisition of Bentley materially increases our capability in beauty manufacturing and product development, and strengthens our position as the leading digital beauty business globally.”

No comments yet