Jewellery specialist Pandora hailed “strong growth” during the third quarter as it reported a rise in revenue and upped its full-year growth guidance, despite a fall in profit.

The retailer posted an 11% increase in revenue in its third quarter to reach DKK5.57bn (£650m), driven by 9% growth in like-for-like sales.

Like-for-like growth in key markets in Europe improved to 4%, while the US grew by 5% and the rest of Pandora “continues strong momentum” at 22%.

EBIT margins were “in line with expectations” at 16.5% for the quarter, will full-year EBIT margin anticipated to reach 25%.

Pandora posted operating profit for the period of DKK920m (£107.3m), down from DKK978m (£114m) in the same period last year.

The retailer credited its ‘Moments’ and ‘Pandora ME’ collections, which generated like-for-like growth by 7% and 12% respectively, during the quarter.

Pandora credited the progress of its ‘Phoenix’ strategy during the quarter, which is part of the brand’s attempt to “transform the perception of Pandora into a full jewellery brand and accelerate growth”.

In terms of outlook, despite remaining “mindful of the macroeconomic climate”, the retailer upped its growth guidance to between 5% to 6%, up from 2% to 5% previously.

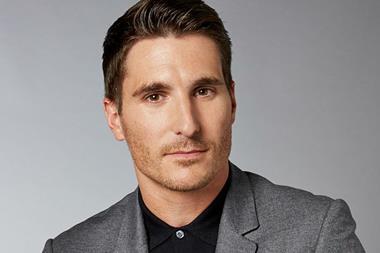

Pandora president and chief executive Alexander Lacik said: “We are very pleased with our results this quarter. Our investments in the brand are attracting more consumers to our stores.

“We have delivered strong broad-based growth whilst our all-time high gross margin underpins our unique earnings model.

“We raise our guidance for the full year and continue to see very exciting opportunities ahead for Pandora as we embark on the next chapter of our growth strategy”.

No comments yet