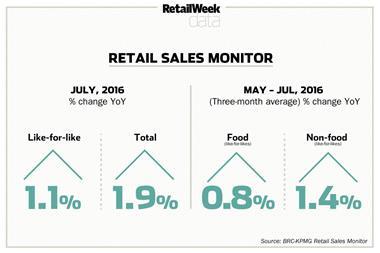

- Like-for-like sales fell 0.5%

- Total sales were up 0.2%

- On a 12-month average basis total retail sales rose 1.2%, the lowest average increase since 2009.

Industry like-for-likes dropped in June as the growth of furniture sales was offset by declining fashion purchases.

Despite like-for-likes falling 0.5%, total retail sales increased 0.2% year-on-year in the five weeks to July 2 and were up 0.5% on a three-month basis, according the BRC-KPMG retail sales monitor.

Although grocery like-for-likes were down in June, food sales rose 0.8% on a three-month average basis, the sector’s best performance since March last year. By contrast, non-food sales recorded their slowest rise since April 2012, up 0.3%.

After showing an uplift in sales in May, fashion purchases continued to fall last month as unseasonably wet weather hurt sales.

KPMG head of retail David McCorquodale said: “As consumer attention shifted indoors to escape autumnal downpours, furniture and home accessories bounced back in the month, with bigger ticket items proving relatively resilient in the days immediately following the EU referendum.

“With May sunshine a distant memory, however, summer wardrobes remained bare as sales of women’s fashion and footwear plummeted following one of the wettest and dullest starts to a UK summer since records began.

“Elsewhere, Euro 2016 kicked things into gear a bit for the grocers, with sales improving 0.8% in the three months April-June. However, the decline on a like-for-like basis suggests food and drink sales continue to be dragged down by the deflationary tide in the sector.”

Referendum impact

The EU referendum is likely to have an impact on retail sales as a result of falling consumer confidence, but the extent to which Brexit will discourage shoppers from shopping is not yet clear.

BRC chief executive Helen Dickinson said: ”While sales did slow towards the end of the month, it is too early to define this as a trend.

“The month outturn was predominantly driven by a decline in sales in the fashion categories and isn’t a surprise given that June 2015 saw record growth in clothing and footwear.”

Dickinson added that the impact of Brexit would not immediately affect shoppers.

“Despite the fall in the pound, the time it takes for any input price increases to translate into higher shop prices will depend on a combination of factors including further changes in the pound, commodity prices and the challenge for retailers to move pricing given the intensity of competition,” she said.

”So, there won’t be any instant shocks as any changes would take time to feed through.”

No comments yet