Moonpig has posted a dip in revenues and sales as customer spend dropped in line with easing restrictions.

Adjusted EBITDA for the six months to October 31 fell 15.1% to £35m, while revenues dipped by 8.5% to £142m.

Moonpig attributed this to tough comparables in the height of UK lockdown last year, when customer spend was forced online.

The greetings card specialist recorded revenues up 115% on a two-year basis, however, which it said was indicative of significant growth of its customer base, higher purchase frequency and the growth of its gifting division.

During the six-month period, Moonpig delivered 19.5 million orders, with 89% coming from existing customers, representing a very high retention rate.

App orders also now represent 42% of Moonpig’s total, while its gifting share of total revenue is now 48%.

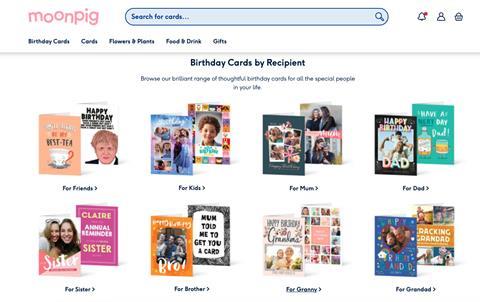

Moonpig is looking to expand its gifting proposition to become the “ultimate gifting companion”. During the period, the retailer introduced a branded shop-in-shop partnership with Virgin Wines, launched fragrances and expanded its letterbox gifting range and branded toys offering.

Moonpig chief executive Nickyl Raithatha said: “Moonpig Group continues to successfully deliver against its strategy to become the ultimate gifting companion.

“Our new technology and data platform continues to make it easier for customers to remember, find, create and send the perfect greeting card and the perfect gift to their loved ones.

“As a result, our half-year results demonstrated even stronger customer retention and our highest-ever proportion of revenue from gifting.

“With revenue more than doubling over the past two years, we are confident that we have achieved an enduring transformation in the scale of our business. The long-term opportunity remains vast and we have never been in a better position to capture this growth.”

- Sign up for our daily morning briefing to get the latest retail news and analysis

No comments yet