The UK’s trade relationship with the EU has “hit British brands and retailers hard” post-Brexit, according to the latest research by Retail Economics and Tradebyte.

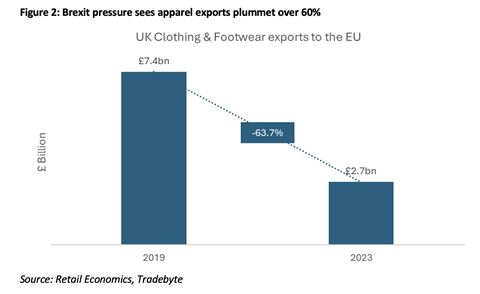

UK retailers have seen international sales to the EU plummet by a total of £5.9bn since Brexit and clothing exports have dropped more than 60%, according to the new report.

Exports of clothing and footwear are said to have faced “significant challenges” since Brexit and have fallen from £7.4bn in 2019 to £2.7bn in 2023.

There has also been an 18% fall in non-food retail exports despite inflation helping to soften the decline.

The sharp drop in exports comes amid challenges including escalated logistics costs, complications of registering an EU entity for trading as well as increased delays.

The delays are said to be a particular challenge due to the increasingly competitive market and high expectations and rapid responses required to keep on top of the latest trends.

Sectors including health and beauty, as well as home and DIY and gardening, are reportedly the only categories that have seen an increase in export values since the UK left the EU in 2019.

As well as this, online opportunities in Europe have ramped up in the post-pandemic world as marketplaces have become “pivotal platforms” for British brands to mitigate the impacts of Brexit on trade.

Retail Economics said online retail is expected to contribute £323bn of sales to EU economies annually but trade friction as a result of Brexit-related complexities is “curtailing” international sales opportunities.

Retail Economics chief executive Richard Lim said: “The profound shift in the UK’s trade relationship with the EU has hit British brands and retailers hard. Successive waves of disruption caused by Brexit and the pandemic have significantly disadvantaged UK exporters who are having to navigate through increased friction and cost.

“Marketplaces have emerged as a lifeline to tap into the EU market which now account for over half of online sales among the most affluent young and middle-aged EU consumers. As UK retailers search for expansion into new territories, marketplaces have emerged as an important channel for growth, opening up new scalable market opportunities at low risk.”

Tradebyte head of corporate relations Alexander Otto added: “International retail is a complicated space to be in, particularly for UK brands and retailers looking to sell in Europe post-Brexit. From language barriers to taxation and customs issues through to warehousing and fulfilment, these are not small obstacles to overcome.

“In today’s marketplace landscape, access to relevant customer data, an intuitive understanding of the market, relevant experience and knowledge of current trends and an effective fulfilment strategy is critical to success.”

No comments yet