PROMOTIONAL RESEARCH

The new generation of consumers demands a different kind of sensory experience. Victoria McDermott takes a look at some of the insights gleaned from Retail Week and Mood Media’s new Shopping with Emotion report

Despite being battered by rising business rates and growing online competition in recent years, retailers are fighting back with renewed strength and a fresh approach that is putting physical stores at the forefront of strategies.

As part of a new Retail Week report produced with Mood Media, a survey conducted with 2,000 consumers revealed that the ability to touch, feel and try the product was the number one reason they choose to shop on the high street rather than online. Read the report here.

It was the top priority for 37% of respondents.

The sensory aspect of shopping is undoubtedly of huge importance to consumers; therefore harnessing this and increasing such experiences should be a prime concern.

Sensory stimulation

Senses and human emotions are playing an integral role in the bricks-and-mortar shopping experience, particularly among the younger generations.

In fact, there is firm evidence that younger generations are particularly influenced by the way shops look, feel, smell and sound.

A massive 90% of 18- to 24-year-olds said they are likely to recommend a shop to others if it has an enjoyable atmosphere.

“Consumers are already tired of yet another app, and millennials and Generation Z are looking for interesting and engaging experiences”

Valentina Candeloro, Mood Media

Mood Media marketing director Valentina Candeloro says: “Having become so digital makes us crave real-life, touch-feel experiences, which is an opportunity to do something totally different within the store.

“Consumers are already tired of yet another app, and millennials (those born between 1981 and 1997) and Generation Z (those born between the mid-1990s and early 2000s) are looking for interesting and engaging experiences.”

Musical notes

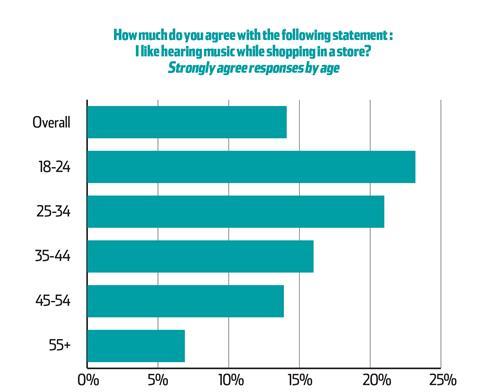

And it is clear that these age groups are eager for those multi-sensory experiences. More than 90% of shoppers aged 18 to 24 like hearing music while shopping in a store, along with 89% of 25- to 34-year-olds.

This is a huge figure when compared with the 65.5% of over-55s who agree with this statement.

And it is not just music these age groups are looking out for – 93% of 18- to 24-year-olds are very likely, likely or somewhat likely to revisit a store with an enjoyable atmosphere.

The emotional connection with music also shone through the research when it came to the 18- to 24-year-olds category, with this age group most likely to feel disengaged, disappointed and unwelcome if no music is playing in a shop, and happy, welcome and uplifted if ‘the right type of music’ is playing.

Going mobile

Unsurprisingly, the Generation Z population are those most tied to their mobile phones. In fact, a resounding 61% of respondents in this age group said they could not live without their mobile phone, compared with just 23.5% of over-55s.

It is therefore no great shock that the younger generation are also wedded to their phones when out shopping.

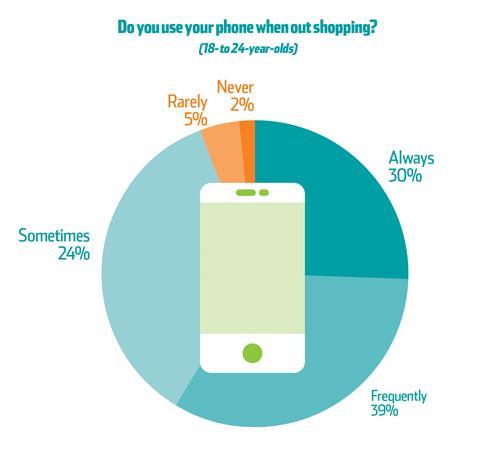

When asked how often they use their phone when on the high street, 30% of the respondents aged 18 to 24 said that they always do, while 39% said they use theirs frequently, and 24% said sometimes.

As the respondent gets older, this phone usage decreases. The most common reason for using mobiles when out shopping is to compare prices, with 27% of all respondents naming this as their top reason.

“Using mobiles or tablets when shopping is something we encourage, and we see it all day. We see it over and over, and a customer with a mobile out searching the net is a definite customer for us”

Store manager

However, for those aged 18 to 24, keeping up to date with their friends was the biggest priority, with 34% naming social media as their top reason for using their phones.

Exactly 50% of all respondents said searching for promotions was a top-three reason for using their mobile device when on the high street, suggesting there is scope for retailers to capitalise on phone usage by sending personalised offers.

The store manager at one electricals retailer says: “Using mobiles or tablets when shopping is something we encourage, and we see it all day. We see it over and over, and a customer with a mobile out searching the net is a definite customer for us.

“We’ll make the experience more fun by offering to download the price comparison app for our customers, or showing them what great value we are by looking at competitors.

“This helps to embed our service level with our customers and means that we are trusted and on their side.”

So, although Generation Z has not fully matured as a population, it is evident that they are already reshaping society as a whole.

And thanks to a lifetime of exposure to digital, the younger generations will be eager to see retailers incorporate more experiential aspects into stores.

Therefore retailers that want to tap into this highly influential and innovative segment should take note, and take action, sooner rather than later.

Young money

The 18-24 age group could prove integral to retailers’ strategies over the coming year, as our consumer research revealed this is the demographic that largely predicts it will be better off this year than in 2016.

In addition, 22% of respondents in this age group forecast they will shop more on the high street in 2017 than they did last year.

Meanwhile, just 5% of the over-55s believe the same.

Download our report

Harnessing the opinion of 12 senior retail directors, five store managers and 2,000 consumers, the Shopping with Emotion report from Retail Week and Mood Media takes a look at how senses can drive sales. Find out:

- Why the value of customer service cannot be underestimated in an increasingly digital world.

- How consumers feel about hearing music while they shop.

- What the future could hold for bricks-and-mortar stores and how human interactions and sensory experiences should be integral to retail strategies.

Downloads

Mood Media-report-April-2017

PDF, Size 2.88 mb

No comments yet