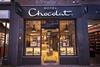

Pret a Manger owner eyes Hotel Chocolat stake

Bridgepoint Development Capital, the private equity owner of café chain Pret a Manger, is eyeing an investment in chocolatier Hotel Chocolat.

Already have an account? Sign in here

By Alex Lawson2013-06-21T15:19:00

Source: Roland Pupupin

Bridgepoint Development Capital, the private equity owner of café chain Pret a Manger, is eyeing an investment in chocolatier Hotel Chocolat.

Already have an account? Sign in here