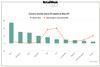

Data: Tesco outgrows big four rivals again

Tesco has outperformed its big four rivals for the second consecutive month as Britain’s biggest grocer continues to gain trading momentum.

According to Nielsen’s latest grocery market barometer, the supermarket giant grew sales 2.2% during the 12 weeks ended May 20, taking its share of the sector to 27.2%.

Already have an account? Sign in here