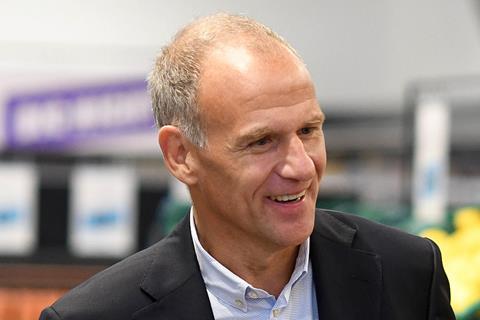

Tesco boss Dave Lewis has blamed the “subdued” Christmas grocery market on widespread promotional activity and heavy investments in price, rather than the fragile consumer backdrop.

Britain’s biggest grocer grew like-for-like sales 0.4% in its core UK and Ireland business during the six weeks to January 4 and registered the biggest sales day in its 100-year history on December 23.

Lewis hailed that as “quite an achievement”, coming against a backdrop of intense price competition in the food market.

Tesco said its basket sizes were “smaller in terms of value” during the festive period as a result of the investments it made in price.

Its own basket of 21 “typical” festive products was £2.28 cheaper year on year, while it also ran a number of headline deals including its ‘Festive Five’ vegetable offer.

Lewis said: “It’s true that, in the Christmas period, promotional participation steps up across the market. If I look at Tesco in total though, this Christmas period versus last Christmas period total promotional participation was slightly lower. Some of our competitors did step up in that period, but Tesco was lower.”

He added: “The market has been flat and slightly negative in Q3 and into Q4. Against that market performance, to have grown is quite an achievement.

“There have been quite a lot of investments – for some people that was promotional, for others it was just price reductions. That has an impact in terms of headline market growth numbers.

“More broadly, going into Christmas it was pretty clear that people were uncertain, unsure and that does translate into people being a little bit more cautious in how they spend their money at Christmastime.

“But I think it is more a feature of the investments that ourselves and others have made.”

Tesco’s big-four rivals Sainsbury’s and Morrisons both highlighted the intense price competition and their respective investments when they filed festive figures earlier this week.

Yesterday, Sainsbury’s said it focused keenly on offering “great value on key food items” during the Christmas period, including the growth of its entry-level own-brand ranges to 160 SKUs and its £9 turkey crowns.

Similarly, Morrisons boss David Potts highlighted its “knockout” deals on British vegetables and said retailers had to respond to fragile consumer confidence with “more activities to get whatever spending is available” during the golden quarter.

Tesco’s Lewis blames price cuts and promotions for ‘subdued’ market

Tesco boss Dave Lewis has blamed the “subdued” Christmas grocery market on widespread promotional activity and heavy investments in price, rather than the fragile consumer backdrop.

Currently

reading

Currently

reading

Tesco’s Lewis blames price cuts and promotions for ‘subdued’ market

- 2

No comments yet