Asda boss Andy Clarke has claimed the grocer is stealing share from its rivals while stemming ground lost to the discounters.

Clarke, who unveiled a 0.1% first-quarter like-for-like increase this morning, told Retail Week: “We’ve got a clear strategy in place, it’s winning in the market, we’ve mitigated losses from the discounters and we’ve gained from the other three.

“We’re performing ahead of Morrisons, Tesco and Sainsbury’s.”

He said the shift in consumer habits towards online and value has given rise to “opportunities and challenges”. “Particularly in grocery there are winners and there are very clearly losers. We are winning. Our strategy is working,” he said.

When asked if he believed there was a price war in the grocery sector, Clarke said: “Not from my perspective. Our combination of EDLP with EDLC [everyday low costs] means we’re in control of our agenda.

“I said we’d shift our position and leave the big three to one side. In the data you can see that. We’re a business in growth. There’s a clear repositioning of our business versus the big three. We have a strategy, not a slogan.”

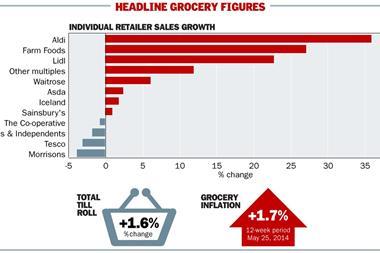

Asda has managed to arrest its market share decline in recent months. It maintained a flat share in the 12 weeks to April 27 as Tesco’s fell 1.3 percentage points, Morrisons’ by 0.6 and Sainsbury’s by 0.2, according to Kantar data.

Asda chief financial officer Alex Russo said: “Slowly but surely we’ve started to close the gap with Aldi. That plan will continue at pace for the rest of the year.” He added there has been “an acceleration of the [customer] move from the big three to us”.

Asda has ramped up investment in multichannel and price in order to bolster its position in the market. “There’s been a clear change in strategic agenda from last November,” Clarke said. “Our low cost operational model underpins the value proposition and investment plan. We’ll continue to invest in high-end technology to support capacity and innovation.”

The retailer also gave more detail on its restructuring proposals, revealed by Retail-week.com this morning, that involves placing 4,100 jobs in consultation. Clarke said the grocer aims to position itself for the continued shift to multichannel.

“There’s been more change in the last five years than the previous 25 years,” said Clarke. “We recognised that early and [are ensuring we’re] fit for the future. The structural change in the market is being driven by the growth of online.”

The restructure will result in a net 900 new jobs, such as more senior multichannel roles, however, the changes could lead to as many as 2,600 people opting to leave the retailer rather than take on alternative lower-paid jobs.

Clarke said: “Some will take a different role, some may choose to leave the business.”

The retailer plans to enhance its multichannel operation by rolling out click-and-collect to 600 points across the UK. It has click-and-collect points in 330 stores at present and also a handful in London Underground stations. “London is absolutely key for us to increase capacity,” said Clarke.

Asda also revealed total sales up 1.3% in the 15 weeks to April 20 and Russo said Easter was “very well executed and planned. Reaction from customers was fantastic”. Asda increased its share of the online grocery market to 19.2% in the period, driven by click-and-collect.

Clarke added he felt confident on the outlook.

“The economy is seeing early signs of recovery,” said Clarke. “That’s given us the confidence that in this market there is some growth. Unemployment is falling and that’s great news. Disposable income is also showing a positive trend across all regions that we measure.”

No comments yet