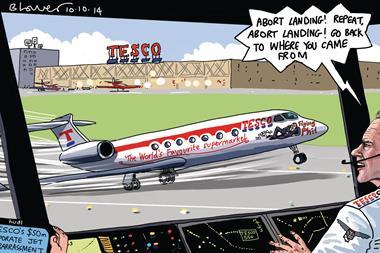

TPG is eyeing a £2bn bid for Tesco’s data business, Dunnhumby, as a fifth executive is suspended over the grocer’s £250m profit overstatement.

TPG made an approach several months ago to Tesco about acquiring Dunnhumby, a wholly owned subsidiary of the grocer. Tesco is understood to be examining its ownership of Dunnhumby as part of a broader review of its business being led by new chief executive Dave Lewis.

The review was already under way before Tesco’s shock disclosure last month that it had overstated profits by £250m overstatement. It has emerged that a fifth Tesco senior executive has been suspended in the wake of the accounting scandal. Commercial director Kevin Grace was asked to stand aside yesterday, according to the FT.

It follows the suspension of UK managing director Chris Bush, UK finance director Carl Rogberg, food commercial director John Scouler and Matt Simister, who is responsible for sourcing.

TPG’s enquiry about a purchase of Dunnhumby came while Mr Lewis’ predecessor, Philip Clarke, was still running Tesco prior to his ousting in July, according to a source.

TPG first enquired about buying Dunnhumby in July, while Clarke was in charge of Tesco. While the approach was rejected and no formal talks have taken place, it is understood that TPG remains interested in the business.

Other private equity firms and big marketing services holding companies are also expected to be interested in the firm.

Dunnhumby was a crucial architect of Tesco’s Clubcard scheme and since Tesco took control of it in 2004 has expanded rapidly and counts Coca-Cola, Procter & Gamble and Shell as customers.

Meanwhile, it has emerged that Tesco chairman Richard Broadbent might consider resigning after the investigation into company’s accounting practices is complete.

Broadbent hinted to board members that the right time for his departure might come after Deloitte finishes its investigation into the grocer’s £250m profit overstatement, the Wall Street Journal reported, citing sources familiar with the matter.

Tesco discloses £250m overstatement of profit forecasts

Tesco has revealed that expected profit forecasts for the first half of this year have been overstated by £250m and has called in accountants and lawyers to investigate.

- 1

Currently

reading

Currently

reading

Fifth Tesco executive suspended as TPG eyes £2bn Dunnhumby bid

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

6 Readers' comments