December’s retail sales suffered their worst volume growth in seven years, according to the Office for National Statistics (ONS).

Month-on-month, overall volume sales shrank 1.5% during December. Value sales dipped 0.9%.

Non-food stores suffered the biggest loss with both volume and value sales decreasing 0.6%.

In-store grocery volume sales diminished 0.4% and value sales fell 0.2%.

Online sales shrank by 0.2% when measured by volume and 0.4% when measured by value.

Year on year

Year on year, overall volume sales rose 1.4%, while value sales increased 4.4%.

Non-food stores’ volume sales grew 0.7%, while value sales nudged up 1.5%.

In-store grocery volume sales fell 0.2%, but value sales climbed 1.2%.

Online, volume sales were up 0.6% and value sales inched up 1%.

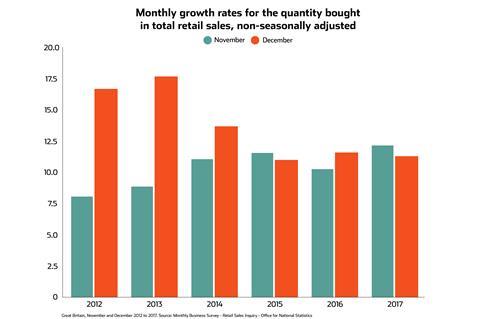

ONS senior statistician Rhian Murphy said: “Consumers continue to move Christmas purchases earlier, with higher spending in November and lower spending in December than seen in previous years.

“However, the longer-term picture is one of slowing growth, with increased prices squeezing people’s spending.”

The year in review

Overall, 2017 had the slowest annual growth since 2013 as volume sales grew just 1.9%. The ONS said golden-quarter retail sales would add almost nothing to overall economic growth for the last three months of 2017.

While December sales were poor, November’s retail sales were a bright spot in comparison, growing 4.7% in volume and 1.4% in value.

November spending has gradually outstripped December spending over the past six years.

Outlook

PWC UK consumer markets leader Lisa Hooker added that the outlook for retail was troubled due the annualisation of inflation and a dint in consumer confidence.

“Today’s numbers from the ONS show the UK’s retail sector had a respectable Christmas trading period – with sales just remaining in positive territory.

“However, with the volume of grocery sales starting to decline, it will be hard for the sector to maintain these growth levels as inflation starts to ease.

“Looking ahead, the outlook for retailers remains tough, with muted consumer demand as real incomes are squeezed. Nonetheless, we expect to see both winners and losers in every category of the retail sector.

“Shoppers will gravitate to brands offering a compelling and differentiated proposition, as well as value for money, which will become increasingly important as purse strings are tightened.”

No comments yet