PROMOTIONAL RESEARCH

Less than half (42%) of retailers in shopping centre locations currently receive footfall data from landlords, Retail Week research has found.

The data throws into sharp relief the need for greater collaboration between retailers and shopping centre operators.

Malls: great expectations, Retail Week’s new white paper produced in association with property management systems firm Yardi, surveyed 50 retail directors responsible for store portfolios to gain a greater understanding of what retailers want from shopping centre landlords.

This comes at a time when the relationship between landlords and retailers is under great strain because of the vast number of company voluntary arrangements (CVAs) that have been launched this year.

Our research finds that improved data collaboration between shopping centres and retailers is an area that could not only improve retail performance but differentiate landlord offerings.

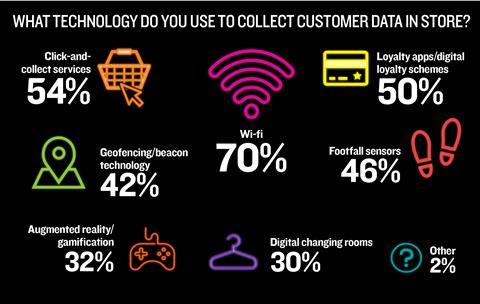

Increased amounts of data captured by new technology can provide landlords and retailers with a complete picture of customer habits, which can impact shopping centre layout and location decisions.

Data collaboration between shopping centres and retailers is an area that could not only improve retail performance but differentiate landlord offerings

Exploring how shopping centres can create an environment in which retailers can thrive in a digital era, Retail Week’s research found strong similarities in what retailers want from their centre managers.

While current platforms for data sharing – typically management software and spreadsheets – have been well-received, there is a strong feeling that shopping centre owners could become more collaborative with retailers in order to enable greater data sharing.

Seventy per cent of the retailers surveyed set KPIs with shopping centre managers, which are generally analysed at least once a week.

However, retailers also say they want more data on footfall figures and dwell time in the centres to better understand the local catchment and adapt store space accordingly, thus reducing the risk of vacancies.

By embracing new technology to help analyse the performance of stores within each location, shopping centres can work in tandem with online and remain relevant in the digital economy.

Find out more

Reduce your risk of vacancies with our digital white paper, in association with Yardi, which includes:

- Exclusive quantitative research from 50 retail directors responsible for store portfolios

- How more data sharing could vastly improve the performance of your centre

- Advice on how collaboration can create success, for both retailers and landlords

Download Malls: great expectations today.

1 Reader's comment