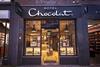

How WHSmith, Joules and Hotel Chocolat keep stores singing

WHSmith, Joules and Hotel Chocolat all provided strong trading updates today – and central to each of their triumphs was the performance of their stores.

Already have an account? Sign in here