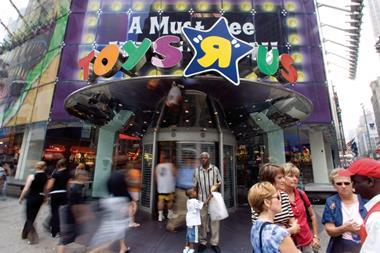

Toys R Us’ pre-tax profits rocketed in its latest full year, but sales dipped amid what the retailer described as a ‘competitive market environment’.

The big box toy specialist unveiled an 82% jump in pre-tax profits to £42.7m in the 12 months to January 28.

According to documents filed at Companies House, the retailer’s operating profit totalled £21.3m, compared with £8m the previous year.

However, sales fell 4% in the period to £418m.

The UK business – part of the US-based Toys R Us group – pointed to a ‘competitive’ market environment.

It said it hopes to drive both store and online sales by improving its product, maintaining product margin, and offering competitive pricing. It also plans to reduce distribution and administrative costs.

At the end of the period, Toys R Us operated 100 stores, compared with 78 the previous year.

Making a turnaround

While Toys R Us did not specify what has driven the spike in profits, the accounts show its administrative costs were 44% lower year-on-year.

Its employee numbers remained the same, but it significantly reduced the amount of money paid to company directors.

For the directors, remuneration totalled £429,000 in the period, compared with more than £2m the year before.

In its 2015 financial year, the retailer’s profits rocketed after four consecutive years of decline. At the time, it remained tight lipped on what had driven the turnaround.

Looking ahead

The retailer said that, following last year’s Brexit vote, “there is considerable uncertainty in regards to interest rates, currency values, consumer disposable income and consumer spending”.

While it intends to “adapt as necessary”, it said it currently has no specific plans in place to mitigate the impact, “as the full effects of the vote will not be known for some time”.

It insists that, despite the uncertain outlook, it is “well placed” to manage its risks.

No comments yet